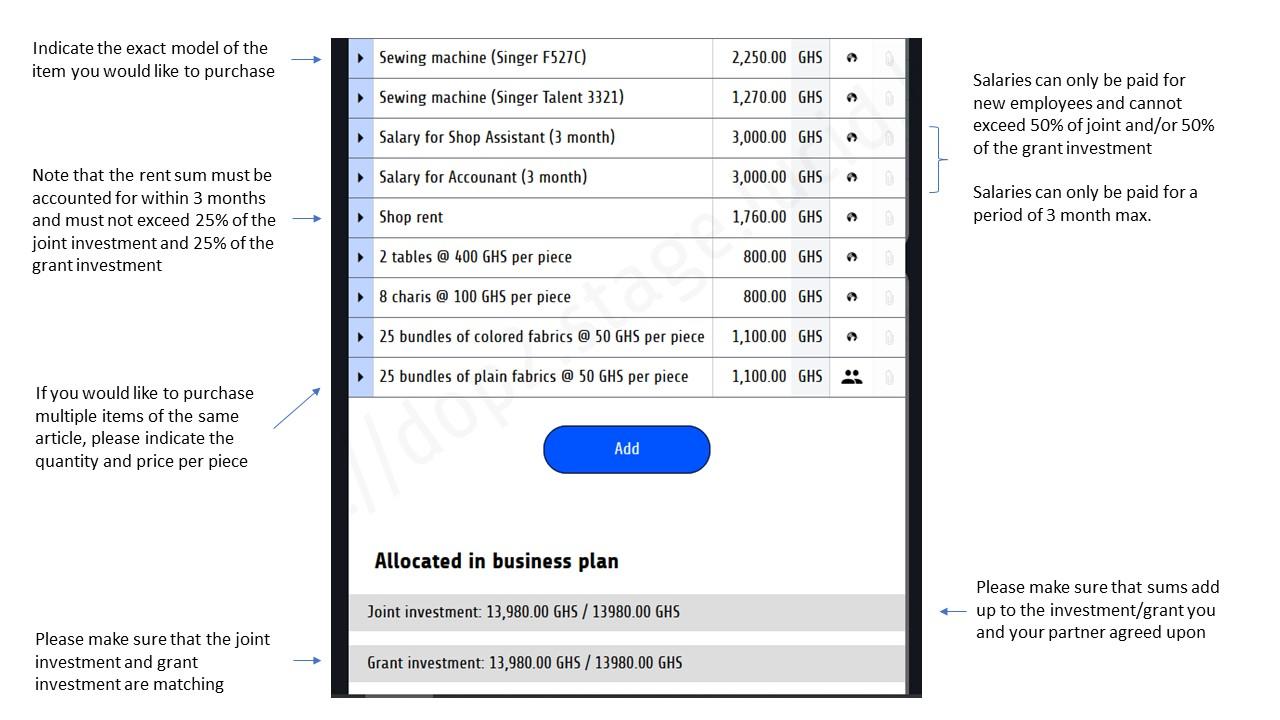

A key element in the application process is the Investment Plan. It is important to be as clear as possible in what you want to purchase. The video "WIDU.africa Investment Plan: How to fill it out" demonstrates what to watch out for when filling it based on a real example.

Rules for the Items in the Investment Plan

General regulations:

- Investment plan items need to be spendable and accountable within three months of project approval

- Partial payments are not allowed (e.g. Car is paid 50% by Private Investment and 50% by WIDU Grant Investment)

- Payment of loans/financial services are not allowed (e.g. loans, bank or exchange rate charges)

- No petty cash or cash reserves

- Receipts must be issued after project approval

Items that cannot be funded through WIDU:

- Illegal goods

- Drugs, alcoholic beverages etc.

- Medicine

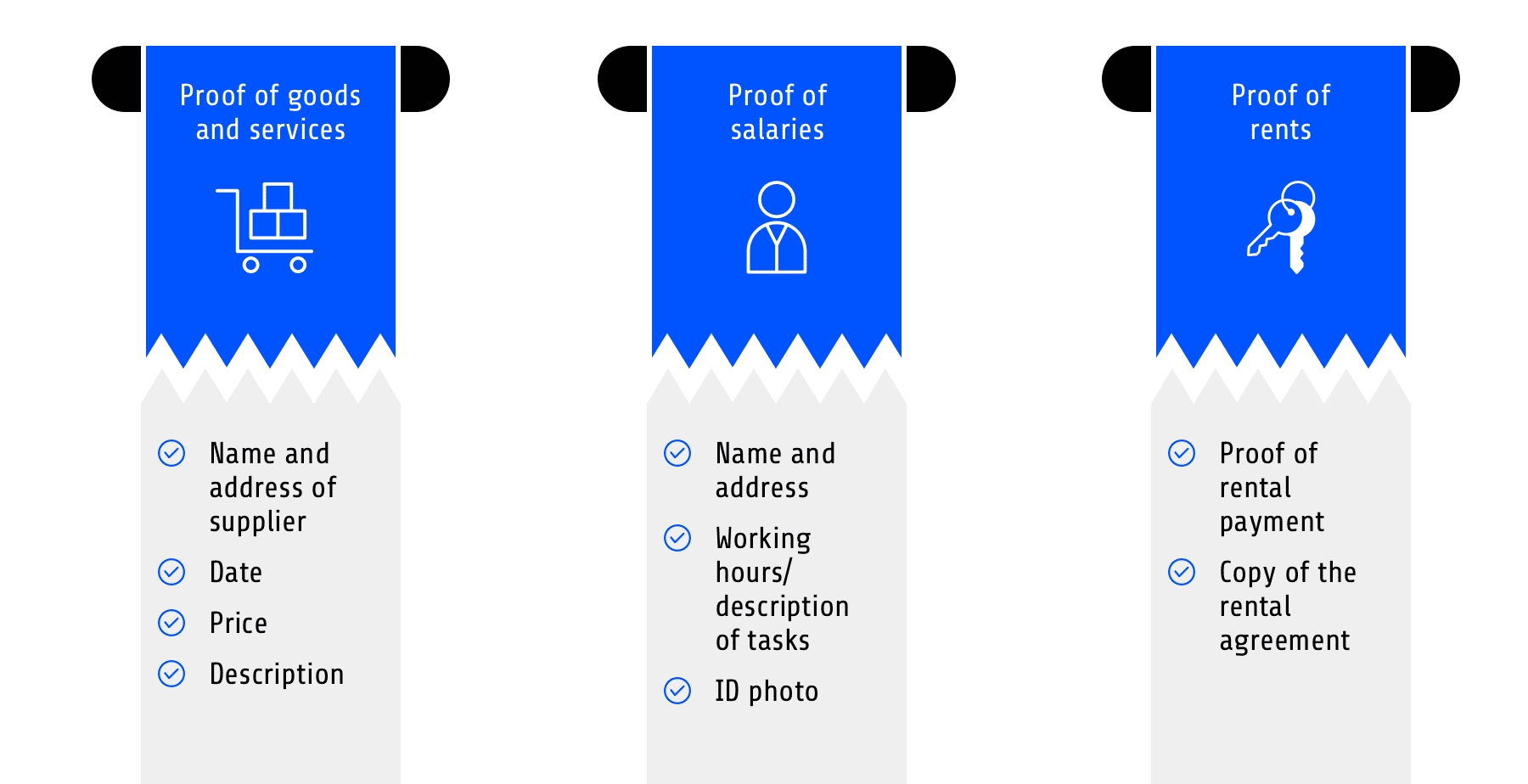

Receipts: Financial Documentation Required

When updating the investment plan with the items purchased from the Private Investment and the WIDU Grant investment, please make sure that the receipts/invoices you provide for the business expenses include adequate information on the business transaction:

Please be aware that we will reject projects if the documentation of the expenses is incomplete or does not fulfill minimum standards.